The 340B Program remains controversial. Hospitals and other Covered Entities (providers qualified to buy drugs at 340B prices) that benefit from the program describe it as a lifeline that keeps them in business. Pharma sees 340B as a program that has grown well beyond its original purpose, and at their expense. This controversy has created fracture lines that run in many different directions. The fractures are being created by lawsuits, government regulations, federal law, and other factors. We’ll describe the cause of each fracture and where those cracks meet, leaving you to decide how stable the 340B Program is.

Covered Entity Litigation Against the Government

One ongoing legal battle is occurring between Covered Entities and the government.

Starting in 2018, Medicare reduced reimbursement to providers for drugs purchased at 340B prices. Medicare’s standard reimbursement formula for physician-administered drugs is Average Sales Price (ASP) plus 6%. In other words, Medicare will allow for a 6% profit on drugs, intended to cover the costs and efforts of ordering, storing, preparing, and billing for those drugs. However, this formula creates a much higher profit for those providers who can purchase drugs at 340B prices instead of ASP. In fact, it is at least 23.1% more profit, and very often much higher than that. The government saw that as an unreasonable profit at Medicare’s expense. Their solution was to reduce reimbursement for 340B drugs from ASP + 6% to ASP – 22.5%. Claims codes have been established that indicate which drugs were purchased at 340B prices and therefore get lower reimbursement.

The hospitals sued, arguing the government can’t change the reimbursement formula like that (we’re avoiding all the legal lingo here). After running through the legal system, the courts agreed that CMS should not have changed the formula. In September, the courts directed CMS to restore the standard formula immediately and find a way to retroactively provide full reimbursement to Covered Entities.

Contract Pharmacy Litigation

The other significant court battle involves the use of Contract Pharmacies by Covered Entities.

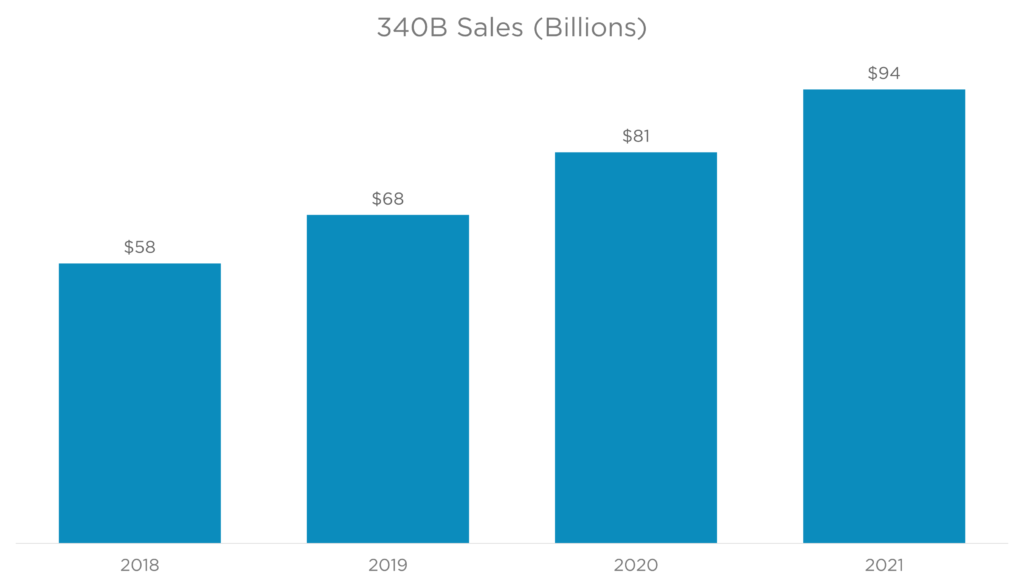

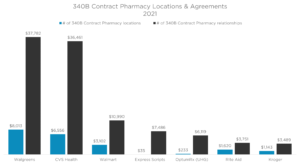

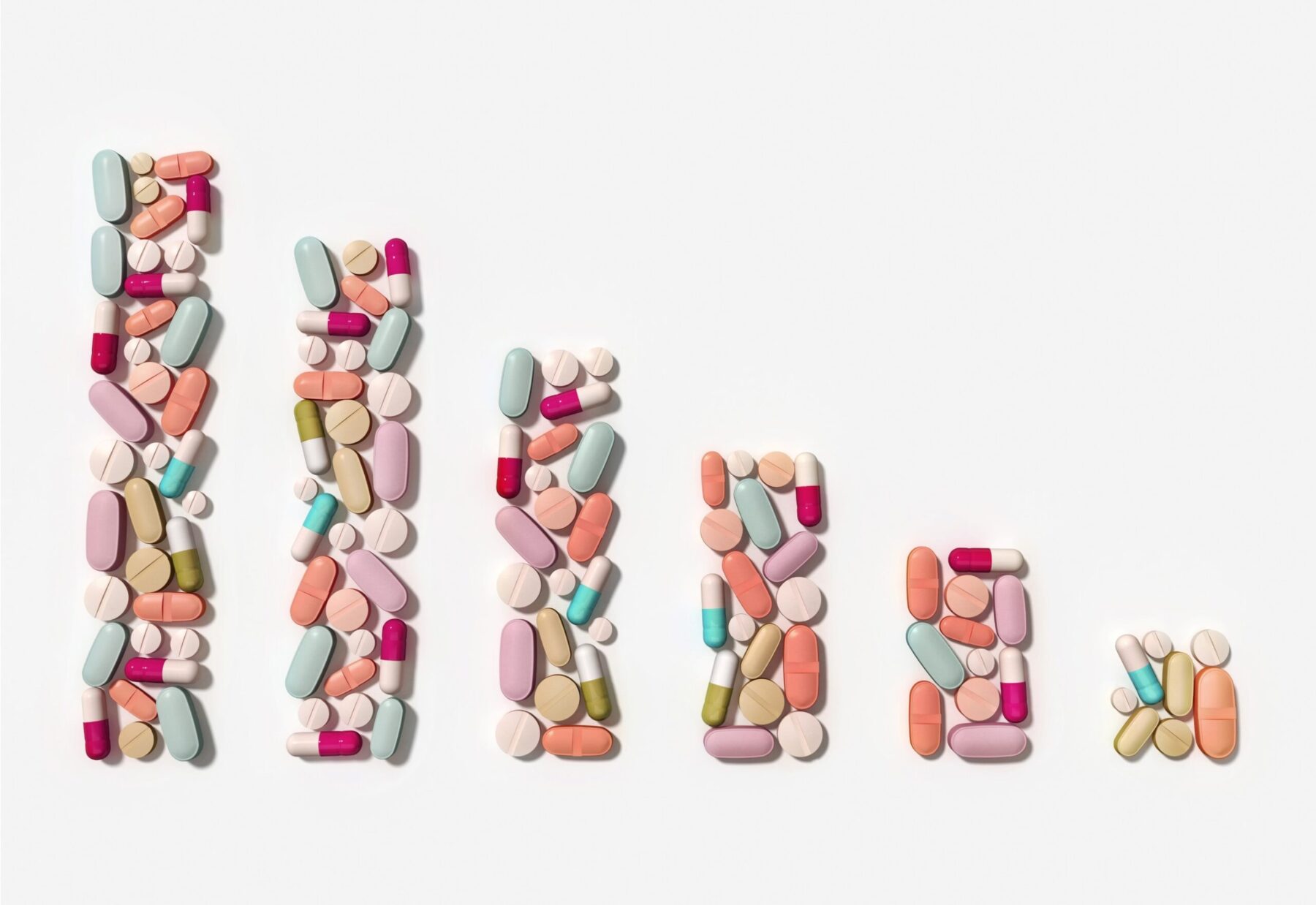

The use of contract pharmacies has exploded (figure 1). Covered Entities contract with different types of pharmacies (figure 2) to distribute drugs purchased at 340B prices. This is allowed under federal law. Manufacturers believe these hospitals use the revenue collected from Contract Pharmacy sales to increase their profits rather than benefit patients.

Pharma position

20 drug manufacturers have made the decision to restrict 340B sales to Contract Pharmacies. Click here to see some of those companies. There are primarily two approaches being taken by those companies:

- Some companies are simply not selling their products at 340B prices if the shipment is intended for a contract pharmacy. These companies are generally still selling their products at 340B prices if the shipment is intended for a Covered Entity (i.e., a hospital that qualifies for the program)

- Other companies have requested that Contract Pharmacies provide claims data that indicates a prescription was filled with 340B drugs

By asking for claims-level data, companies can avoid duplicate discounts (figure 3) between the Medicaid program rebate and the 340B price discount. Selling a drug at its 340B price and then providing a rebate to Medicaid can completely eliminate all revenue from that prescription. It may even result in a manufacturer paying money at the end of the transaction (a negative net revenue).

Provider (Covered Entity) position

The Covered Entity’s position is pretty straightforward: The 340B statute requires manufacturers to supply their products at 340B prices regardless of the involvement of Contract Pharmacies. Covered Entities love their Contract Pharmacies; use of Contract Pharmacies increased 4,228% between 2010 and 2020. They will go to great lengths to protect the model.

The Government’s position

The Health Resources and Services Administration (HRSA) agrees with providers. So much so that HRSA sent enforcement letters to many manufacturers that threaten the imposition of Civil Monetary Penalties (CMP) for refusing to sell their drugs at 340B prices. These CMPs can result in revenue loss that can be many times the loss from simply selling the drug at 340B prices.

The Court’s position

Many courts at different levels (short of the Supreme Court) have weighed in on the topic. The results are very much mixed:

- Some courts agree with providers that manufacturers must sell their products at 340B prices as requested by Covered Entities, even when that includes Contract Pharmacies

- Other opinions are that the 340B statute doesn’t prevent manufacturers from setting conditions on 340B sales (like asking for claims data to prevent duplicate discounts)

- Some courts saw HRSA’s position as reasonable, but not the only reasonable position. These courts have “set aside” HRSA’s enforcement letters that threaten CMPs on manufacturers

In summary, the battle over Contract Pharmacies has progressed through the courts without final resolution. Each stakeholder feels strongly about their position, and no compromise is in sight. This issue may be a significant crack in the 340B Program that doesn’t currently have a solution likely to satisfy all parties.

Connecting the Legal Dots

There are lines of connection between the litigation results we just described and impending changes to the market.

Setting a different reimbursement formula for 340B drugs requires claims-level data that identifies drugs as 340B. This is one place where issues intersect. Recall that some manufacturers are requesting that claims identify 340B drugs so they can avoid duplicate discounts. Because CMS had established claims modifiers to distinguish drugs that will get lower reimbursement, the data is currently available to share with drug manufacturers.

Key Changes That May Crack the System

There are two market developments that may impact the future direction of the 340B Program.

The first is the court’s decision that prohibits reduced reimbursement for 340B drugs. This means the most powerful driver in the healthcare industry (the U.S. government) will no longer need to drive the use of 340B claims modifiers. If those modifiers are no longer required, will pharma manufacturers be able to identify 340B sales by contract pharmacies in their efforts to avoid duplicate discounts?

Another change in the market may give those manufacturers some hope. The Inflation Reduction Act (IRA) passed in August may create a new driver that necessitates the use of 340B claims modifiers. A new inflation penalty is an important part of the IRA. This penalty will take the form of a rebate and be levied against manufacturers who raise their prices faster than the inflation rate. A stipulation in the law states that the penalty will not be levied if the drug was purchased at the 340B price. This may create a new driver to include a claims modifier for 340B drugs.

Who Is Creating Cracks in the Program? Who Is Patching Those Cracks?

Let’s summarize the positions of key stakeholders. This will tell us who is creating cracks in the program, and who is trying to save the program by patching those cracks.

Providers

Providers are doing everything they can to repair any cracks they see in the 340B Program. They actively seek ways to leverage their 340B purchasing power, and Contract Pharmacies are one vehicle for this. The acquisition of physician offices and other sites of care are another. The provider lawsuits we described have succeeded in protecting their expanding purchases of discount drugs while protecting their reimbursement margins.

Pharma

Pharma’s efforts are clearly intended to create cracks big enough to break off chunks of the program, specifically related to Contract Pharmacies. It was a proactive decision on the part of a few manufacturers to push back on sales to Contract Pharmacies, which represent the biggest expansion of the 340B Program. Other manufacturers have joined in. We can expect more to join in, given the somewhat successful defense of their position in the legal system.

The Government

The Biden administration is all-in to protect the program. Even the reimbursement cuts that started under the Trump administration were not intended to limit the program (just limit Medicare expenses). This means the government is also patching cracks wherever it sees them.

PBMs and Insurers

We haven’t mentioned PBMs and insurers yet, because they are quietly remaining behind the front lines. Despite their low profile in this matter, these stakeholders have efforts underway to profit from the 340B Program by negotiating for lower reimbursement rates when the drug was acquired at 340B prices. This is much like Medicare’s argument; if a provider’s acquisition costs are lower, then reimbursement should be lower. However, PBMs and insurers don’t have nearly the leverage enjoyed by the government, and can’t simply change reimbursement formulas unilaterally. Some insurers believe the profits attainable from the program leads providers to prescribe higher-cost drugs rather than generics that offer smaller 340B profits. So, PBMs and insurers may not be disappointed to see the 340B Program crack apart.

Patients

The vast majority of patients have very little skin in this legal battle. They don’t get much benefit from 340B purchases, as the amount of money they are charged by providers doesn’t change just because the drug was purchased at a discount. There are programs coming to market that may allow uninsured patients to take advantage of 340B pricing, but they are not yet common enough to get patient advocates involved in repairing cracks.

Summary

The last legislation to impact the 340B Program was enacted in 2010. That was the Affordable Care Act, which allowed expansion of Contract Pharmacy utilization by Covered Entities. That expansion has created enough pressure to create cracks in the program. Manufacturers, PBMs, insurers, and even the Medicare program are concerned about the profit incentives created by 340B purchases. They are all taking active steps to insulate themselves from increased provider profits that come at their expense. On the other side of the battle, Covered Entities hope to have enough spackle and putty knives (in this case, lobbyists in Washington) to repair cracks before they get big enough to bring down the whole structure.

Want to learn more about drug pricing and the 340B Program? Enroll in our Following the Healthcare Dollar MAP Training Program and begin learning immediately.

Share Post:

Strengthen Your Customer Connections

Understanding the world prescribers are living in allows for more meaningful customer interactions. MAP Training Programs build your knowledge on marketplace trends impacting providers and the pharmaceutical industry today.

Achieve Company Goals

Bring teams up-to-speed on the latest market access trends impacting their unique selling environment.

Keep Your Finger on The Pulse

Subscribe to the Marketplace Blog to stay up-to-date on the latest trends impacting pharma

*required

Marketplace Blog

Trends in the Marketplace

“Negotiating” A Drug Deal with Medicare

[DISCLAIMER: This isn’t a legal analysis. We’ve simplified provisions in the law where we could while still describing the intent of the law] The newly-signed Inflation Reduction Act (IRA) that

Shopping for Healthcare Deals

New price transparency rules set by the government are an opportunity to save money. Not for hospitals, not for payers, but for you and me. Isn’t that a nice change

Are PBMs Actually Pharma’s Friends?

Pharmacy Benefit Managers (PBMs) have received a lot of negative publicity lately. Here is some more: A new whistleblower lawsuit has opened another door that reveals more skeletons in the